The Best Pre-Settlement Loan Providers [2024]

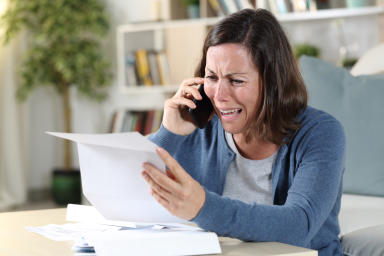

It can be stressful to wait for your funds as you’re waiting for a lawsuit to settle. When you need a cash advance right away, it can be challenging to find the best lender for your needs. There are many options when it comes to lawsuit funding companies. Pre-settlement legal loans can provide financial security while you wait for the wheels of justice to turn. A pre-settlement loan can help folks cover medical bills, mortgage payments, and other living expenses while you pursue your case.

What Is a Lawsuit Loan?

During your search, you may have noticed that lawsuit funding goes by many names, including settlement loans and lawsuit loans. However, it isn’t a traditional bank loan. Instead, it’s a cash advance against a portion of your future settlement award. Pre-settlement funding offers a much lower risk than a bank loan because there are no repercussions from the lawsuit funding company if the settlement falls through. This means that you won’t have to pay back the funds even if you lose the case.

What Should I Look for When Applying for a Lawsuit Loan?

When applying for a pre-settlement loan, speed is the primary marker of a trustworthy lawsuit funding company. Creditable lawsuit funding companies start working immediately to send you the funds you need within 24 hours of approval. You should be able to speak with a member of their lawsuit funding team who can assist you in real time. Expect to talk with an actual person who can explain what kinds of cases they fund and those they do not. If the company you call subjects you to long holding times or the dreaded voicemail, that’s a good sign to move on.

Clear contract terms and rates

Additionally, a good pre-settlement loan provider should be upfront about the terms of your contract. The contract terms should be easy to understand without a lot of fine print or abstract legal terminology. Like a traditional loan, different pre-settlement funding companies offer different rates. The company should be transparent about its rates and what fees it plans on charging on top of its interest rate. These additional fees can make a huge difference in your bottom line. It is crucial you know precisely how much you’ll pay before you sign a funding agreement.

The terms of the contract should be fair and honest. Exploitative lawsuit funding companies will attempt to charge high rates along with uncapped fees. Many will include application fees or try to charge you double interest rates. You should know that any solid loan servicer will not charge you usage fees or try to take advantage of your inability to pay. Make sure to have your attorney review the entire contract before signing on the dotted line. If you have any doubts, find another loan servicer.

Non-recourse funding policy

One of the most significant factors that will determine your ability to obtain funding is the state you live in. Some states are friendlier for legal financing than others. Check your state’s laws to see whether they offer non-recourse funding. In simple terms, a non-recourse funding policy means you’ll only have to repay the loan if you win or settle your case. If you don’t win your case, the pre-settlement funds are yours to keep. The non-recourse funding policy acts as the ultimate peace of mind during a lawsuit. State laws vary as to who can offer a non-recourse funding policy, so make sure to receive assistance from a loan provider who can legally provide this protection.

Pre-Settlement Funding FAQs

What type of cases can you use a lawsuit loan for?

Each pre-settlement loan provider has different cases that qualify for legal financing. Personal injury lawsuits are one of the most common types of cases used for funding. Car wrecks, workers’ compensation claims, premises liability, and medical malpractice are usually covered. Some providers also offer funding for clients engaged in class-action lawsuits, such as for faulty medical equipment and dangerous product claims. Many other cases that can be eligible for legal funding. Confirm with your pre-settlement loan provider to guarantee your case qualifies.

How much funding can I receive?

How much funding you can receive depends on several factors:

Legal representation

Severity of your injury

How much money you need (living expenses, medical bills, etc.)

Estimate of settlement worth and damages

Are there any fees for this type of loan?

A credible loan provider understands that you need the cash advance for essentials. Therefore, they should not charge unnecessary fees or multiple funding fees, and you should not pay any money upfront. Many reputable pre-settlement loan providers offer free applications.

A reputable lawsuit funding company won’t charge you interest or other fees when you apply for a pre-settlement loan. If they do have additional fees, the loan provider should explain the specific fees and spell out exactly how much you’ll pay. You can use online calculators to double-check the math and ensure you aren’t paying more than you should.

What if I have bad credit?

Bad credit should not be a barrier to receiving pre-settlement funding. Most reliable pre-settlement loan providers do not require a credit check of any kind. If the loan company you talk to tries to run your credit, hang up and find a more trustworthy lawsuit loan.

Do I need an attorney to get a lawsuit loan?

Most lenders require that you have legal representation to receive a lawsuit loan. Not only do you have a better chance of recovering compensation with legal representation, but repayment of your pre-settlement funding comes directly from your compensation package. Having an attorney makes it more likely that the loan will be repaid. This is a way that loan providers protect themselves in the long run.

Best Lenders for Lawsuit Loans

Based on customer evaluations and extensive research, we’ve compiled a list of the best lenders for lawsuit loans. If their rates aren’t online, make sure that you confirm with a representative. No matter which lender you choose, you should expect clear communication about all aspects of your loan and transparency about what you’ll pay.

Best for Smaller Settlements: Oasis Financial

With over twenty years of experience in the legal funding industry, Oasis Financial understands life won’t wait for your settlement. Oasis provides financial support for a variety of personal injury cases, including workers’ compensation. Oasis Financial continually receives high customer service rankings for its no-risk, three-step funding process. They have an A+ rating from the Better Business Bureau and have helped over 250K people get legal funding. When you’re in need of a loan between 5K and 100K, Oasis Financial is the lender for you.

Best for Low Rates: Nova Legal Funding

With low overhead and no application or processing fees, Nova keeps its rates some of the lowest in the industry. Unlike other competitors, Nova doesn’t charge compound interest. Instead, Nova has a fixed fee every six months that is capped between 24 and 36 months, depending on the case. Nova also offers to beat any of their competitors’ rates if your case is approved for funding. Within two minutes, you can apply for pre-settlement funding, and your fees are based on the strength of your case. Reach out to Nova Legal Funding for low rates and high-quality customer service with no risk of repayment.

Best for Fast Approval: Thrivest Link Legal Funding

Whether you need a lot or a little cash quickly, Thrivest Link is one of the fastest pre-settlement funding companies in the nation. Thrivest can fund all kinds of personal injury cases within 24 to 48 hours. Thrivest also offers funding for plaintiffs’ living and medical expenses. Depending on your case type, Thrivest charges both simple and compound rates. Although Thrivest charges less than many of its competitors, make sure to ask for a quote with a simple, non-compounding rate to ensure you get the best deal. Recent reviews suggest Thrivest may be overwhelmed with funding requests and less responsive than other companies. If you run into this issue, reach out to another loan provider who can put money in your hands as soon as possible.

Best for unique cases: USClaims

With some of the lowest rates in the United States, USClaims is one of the best pre-settlement loan providers. They offer simple, non-compounding rates in nearly every US state with easy-to-understand contract terms. The National Law Journal and other major legal publications have named USClaims as one of the best lawsuit settlement loan providers in the country. With fast approval times of as little as 24 hours, they offer non-recourse funding for a variety of case types beyond personal injury, including medical malpractice, civil rights, wrongful death, and many more.

Best for unemployed borrowers: High Rise Financial

When you are out of work and need a pre-settlement loan, it can be hard to find a borrower willing to fund your case. At High Rise Financial, they don’t review your financial situation or require a credit check. High Rise Financial doesn’t take into consideration whether their client is employed or not. Their team is committed to funding a variety of lawsuits, from construction accidents to wrongful death lawsuits. High Rise Financial offers an easy process with no risk and no monthly payments if approved. When you need time on your side, High Rise Financial is a lender you can trust.

Expertise.com StaffAuthor

Step into the world of Expertise.com, your go-to hub for credible insights. We don't take accuracy lightly around here. Our squad of expert reviewers, each a maestro in their field, has given the green light to every single article you'll find. From rigorous fact-checking to meticulous evaluations of service providers, we've got it all covered. So feel free to dive in and explore. The information you'll uncover has been stamped with the seal of approval by our top-notch experts.