How Much Does a Home Warranty Cost?

The expected cost of an annual home warranty is between $400 and $550, according to the National Home Service Contract Association. However, based on quotes we gathered for this article, we found that the average cost of a home warranty is $659.45.

Many homeowners feel financially vulnerable after purchasing a new home. Their emergency fund has been funneled into closing costs and moving expenses, leaving little wiggle room for life’s unexpected surprises.

The last thing most homeowners in this situation want to deal with is a broken dishwasher, or even worse, a ruined heating system. Home warranties offer added protection for your home’s systems and appliances, helping shoulder the burden of replacing or repairing them due to regular wear and tear.

In this article, we walk you through the expected costs of a home warranty system, as well as what a standard plan covers. You can also skip right to our cost comparison to see how some of the top providers compare.

What Is a Home Warranty?

A home warranty is a service contract that covers maintenance, repair, and replacement for major home systems like HVAC, plumbing, electrical, and some appliances.

Home warranties offer replacement or repair for systems and appliances that have failed due to a manufacturer issue or normal wear and tear.

Warranties can be helpful for homeowners with older homes or with major home systems that are nearing the end of their life span. Even if everything is in perfect condition, a home warranty can be something to fall back on in the event of an unexpected (and costly) emergency.

How Does a Home Warranty Work?

A home warranty is a service contract that typically offers coverage for one year. Homeowners can opt to continue their coverage at the end of the contract or cancel.

When a covered system or appliance breaks, you’ll file a claim with your provider and they will send a pre-approved contractor to assess the problem. You’ll pay the service fee for the contractor’s labor, and if the claim is covered by your warranty, your provider will cover the remainder of the replacement or repair cost.

What Does a Home Warranty Cover?

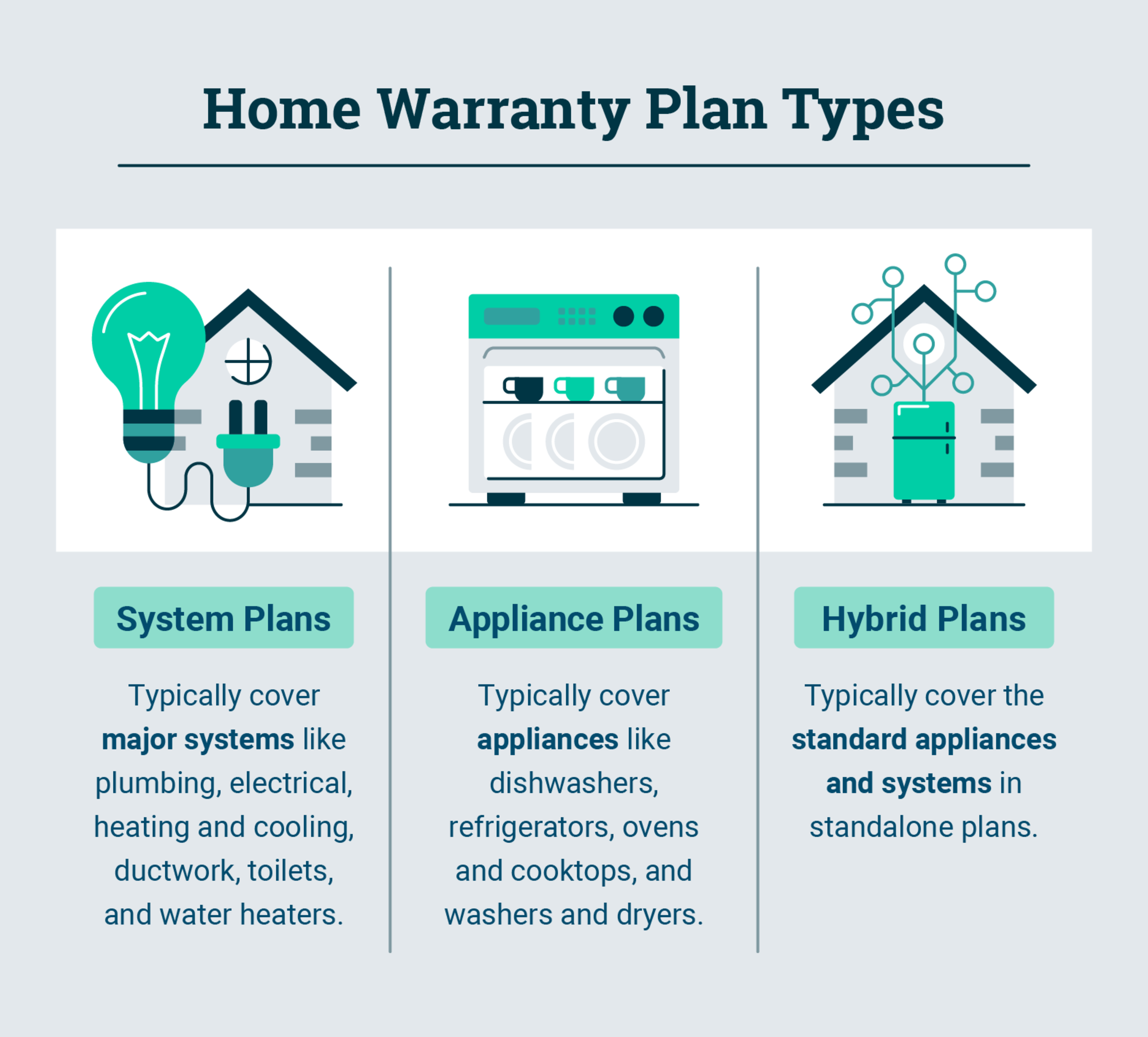

The breadth of your home warranty coverage will depend on the options available by the provider and the service plan you choose. Most providers offer three types of warranties: an appliance plan, a system plan, and hybrid plans.

System plans: These plans focus on your home’s major systems like plumbing, electrical, heating and cooling, ceiling fans, ductwork, toilets, and water heaters.

Appliance plans: These plans focus on your home’s appliances like microwaves, dishwashers, refrigerators, ovens and cooktops, garbage disposals, and washers and dryers. These tend to be less expensive than system and hybrid plans.

Hybrid plans: These plans cover a combination of your home’s systems and appliances, making them a popular choice among homeowners.

Home warranty providers may not offer the exact system or appliance coverage you want. To help you customize a plan to your liking, providers offer add-ons at an additional cost. These can include electronics, pools and spas, water softeners, faucets and fixtures, and yard sprinkler systems.

What Is Not Covered by a Home Warranty?

Home warranties do not provide coverage for your home’s exterior, walls, windows, doors, or floors. Instead, they focus on systems and appliances within the home.

The home warranty plan you choose will impact what is and is not covered by your provider. Generally, the following items are not covered by a standard home warranty or as an optional add-on:

Cosmetic imperfections such as scratches or dents

Improper installation

Damage caused by a failure to maintain your systems or appliances

Pre-existing conditions (aka problems identified during a home inspection)

Damage from termites or pests

Average Cost for a Home Warranty

The expected cost of an annual home warranty is between $400 and $550, according to the National Home Service Contract Association. However, based on quotes we gathered for this article, we found that the average cost of a home warranty is $659.45.

How much you pay for a home warranty will depend on the provider you choose, but most warranties fall within that range.

Home Warranty Cost Factors

There are a handful of factors that can impact your home warranty cost. These include:

Your service call fee: A service call fee is a flat rate that will cover the labor costs for a contractor to come to your home and diagnose a problem. Many providers allow you to choose your service call fee amount, but keep in mind that a lower service call fee can increase your monthly home warranty cost — and vice versa.

The plan you choose: Most of the providers we researched offer at least two plan options. The basic plans are the cheapest and tend to offer a standard assortment of coverage, such as plumbing, electrical, and heating and cooling systems. More comprehensive plans come at an added monthly cost and include coverage extras like kitchen and laundry appliances, dishwasher, water heater, and ductwork.

Add-ons you pick: Providers offer add-on services that allow you to customize your home warranty coverage for an added cost. Popular add-ons include sump pump, pool or spa equipment, roof leak repairs, laundry appliances, kitchen appliances, and HVAC tune-up.

Home Warranty Cost Comparison

Below, we gathered cost estimates for the top 10 home warranty companies that rated highly on third-party sites to give you a look at what you can expect to pay.

The quotes we gathered above were based on a 1,120-square-foot home in Kansas City, Missouri, built in 1930, with the exception of Landmark Home Warranty. The provider only offers warranty coverage in Arizona, Idaho, Nevada, Oregon, Texas, and Utah. For that company, we used a sample home of 1,311 square feet in Dallas, Texas, built in 1958.

Note: We included the companies above to use in our cost comparison research because they were rated highly on credible third-party sites.

It’s also worth noting that many of the providers we gathered quotes for sent follow-up emails with discounts between $175 and $200 that could help bring down the total cost. Shop around for multiple quotes to assess which company offers the coverage you desire with a price tag you feel comfortable with.

Home Warranty Cost Breakdown

There are three main cost categories associated with home warranty: the premium, service call fees, and add-ons.

Premiums

Similar to an insurance plan, the premium is the total amount you pay for your home warranty coverage. You may choose to pay this in monthly installments or in one lump sum.

Service Call Fees

Deductibles, or service call fees, are an expense you’ll pay when a professional comes to perform a repair or maintenance service.

Your service call fee amount will vary based on the premium you pay. Typically, the higher the premium, the lower the deductible. We found that service fee costs can range between $75 and $150, depending on the provider.

Add-ons

Add-ons are upgrades you can tack on that are not included in the original plan. These extras will increase your monthly or annual premium, often by about $2-$30 per add-on.

Home Warranty Coverage Limits

Home warranty plans typically have a maximum coverage limit. This limit determines how much money your provider will spend to diagnose and replace or repair your home appliance or system.

Limits vary drastically among providers. A sample plan at American Home Shield’s ShieldGold plan sets a limit of $3,000 per appliance. Other providers set different limits depending on the appliance or system. Cinch Home Services, for example, sets a total limit of $10,000 for all covered items and specific limits for each appliance — usually between $1,000 and $2,000.

In addition to coverage limits, there are certain instances in which your home warranty will not apply. These are outlined in your service contract. For example, if your plan includes your refrigerator, it may not pay for the replacement or repair of racks, shelves, food spoilage, or lights. Home warranties often do not cover systems and appliances that are still under warranty, which means that a new home with many new appliances may not be well suited for a home warranty.

It’s important to note that many warranties require ongoing maintenance in order for coverage to apply. For this reason, it’s smart to schedule regular inspections for your major systems and appliances to ensure they’re in good working order.

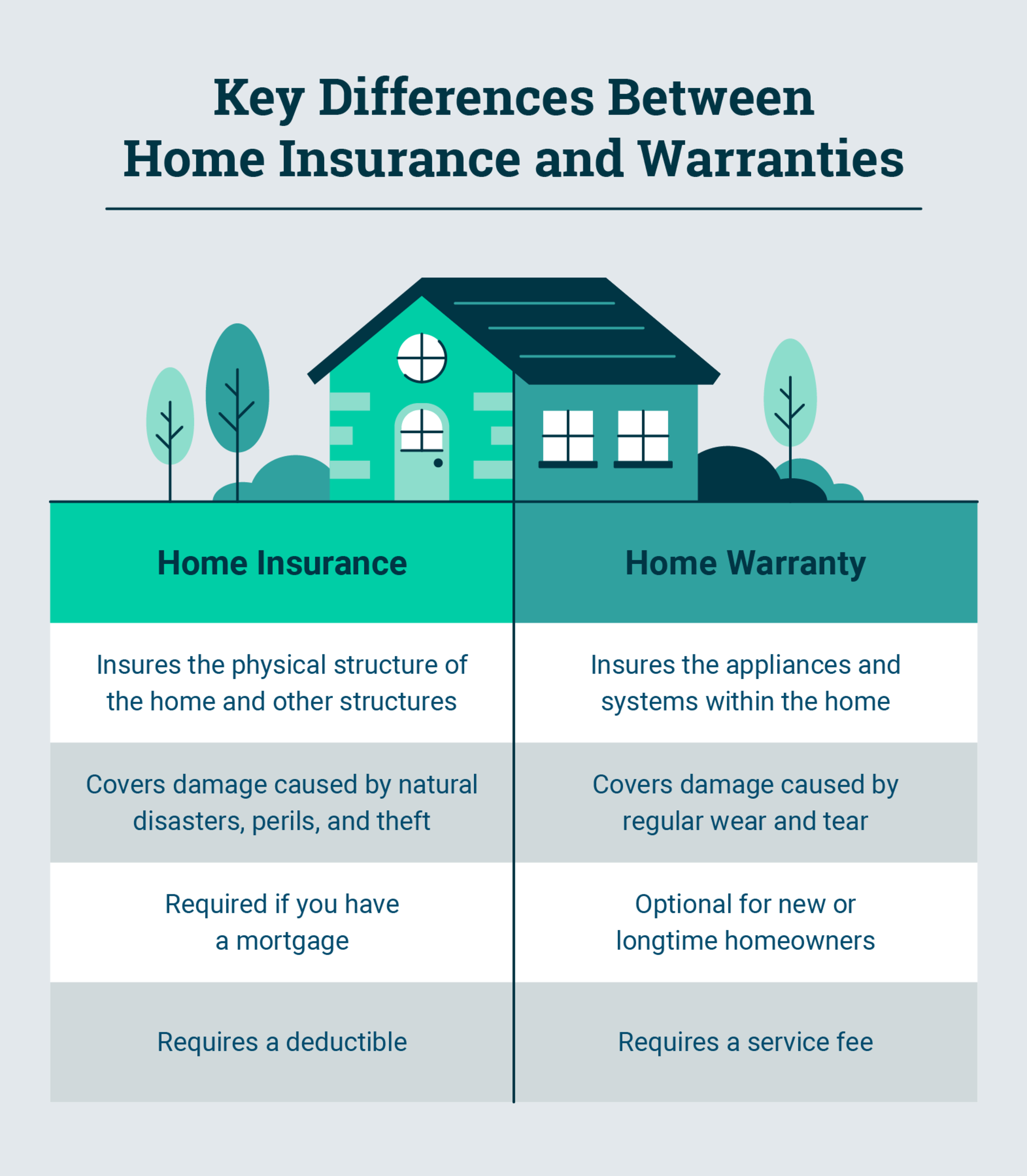

Home Warranty vs. Home Insurance

Homeowners insurance covers damage to or loss of home systems and appliances impacted by a covered event, such as a tornado, fire, or theft.

A home warranty, on the other hand, provides coverage for the repair and replacement of systems and appliances that stop working due to normal wear and tear.

Home warranty example:

If your home’s plumbing system breaks down, your warranty will cover the cost to repair or replace it.

However, your warranty will not cover water damage caused by the broken plumbing system, but home insurance can.

Home insurance example:

If you experience a kitchen fire due to broken electric wires in your oven, your home insurance coverage will kick in to repair the damage to your home.

However, your home insurance plan will not pay for the replacement or repair of your faulty oven. This would be an out-of-pocket expense for homeowners without a home warranty.

Do You Need a Home Warranty?

While a home warranty can be helpful if an expensive appliance or system unexpectedly breaks, there are a couple considerations to think through before purchasing:

The age and condition of your systems and appliances: If your home has older systems and appliances, it’s likely that manufacturers’ warranty plans have long expired. A warranty will fill your coverage gaps and make sure you don’t bear the brunt of replacement costs.

Your financial situation: A new refrigerator can cost between $1,000 and $2,000, which can be a big blow to a homeowner’s monthly budget should their refrigerator unexpectedly quit. A home warranty can be a great choice for homeowners who don’t have a large emergency fund tucked away.

Home Warranty Cost FAQs

Below, we answer some of the most commonly asked home warranty questions.

What Are the Advantages of a Home Warranty?

Home warranties help financially protect homeowners by allowing them to avoid paying the full replacement or repair costs for major home systems and appliances. This offers peace of mind for homeowners, knowing that a professional will promptly diagnose and repair issues as they arise.

Home warranties can also help homeowners cut down on unexpected expenses, as there are clear coverage limits and service fee costs included within their warranty.

Are Home Warranties Worth It?

Home warranties can be especially valuable for homeowners who are on a tight budget. Because the cost of unexpected home appliances and system repairs can be expensive, a home warranty plan can step in to help you cover the cost and protect your wallet.

Research the average cost of repair for your systems and determine if you have enough saved to cover those types of repairs. If not, a home warranty can be a valuable investment.

It’s also smart to consider the age of your home and your major home systems and appliances. Older systems come with an increased risk of needing repairs or replacements.

Am I Required to Have a Home Warranty?

No, home warranties are not a requirement.

Can You Buy a Home Warranty at Any Time?

Yes, you can buy a home warranty at any time no matter how old your home is, how old your systems and appliances are, or how long you’ve lived there.

Warranties are often purchased along with a new home purchase. Some sellers even offer a one-year warranty as a value-add for prospective buyers.

Do I Need a Home Inspection Before Purchasing Coverage?

Most providers do not require an inspection before purchasing coverage.

When it comes to home repair, it’s hard to predict when a refrigerator or plumbing system will suddenly break. Home warranties are there to help protect your wallet when these costly (and essential) home systems and appliances break down.

To help you choose the right provider for your home, check out our list of best home warranty companies of 2022.

Expertise.com StaffAuthor

At Expertise.com, we're passionate about guiding people to find the best in life, whether they're researching how to start a small business, planning a home remodeling project, or discovering a new hobby.