Home Solar Panels: Pros, Cons, and Hidden Costs

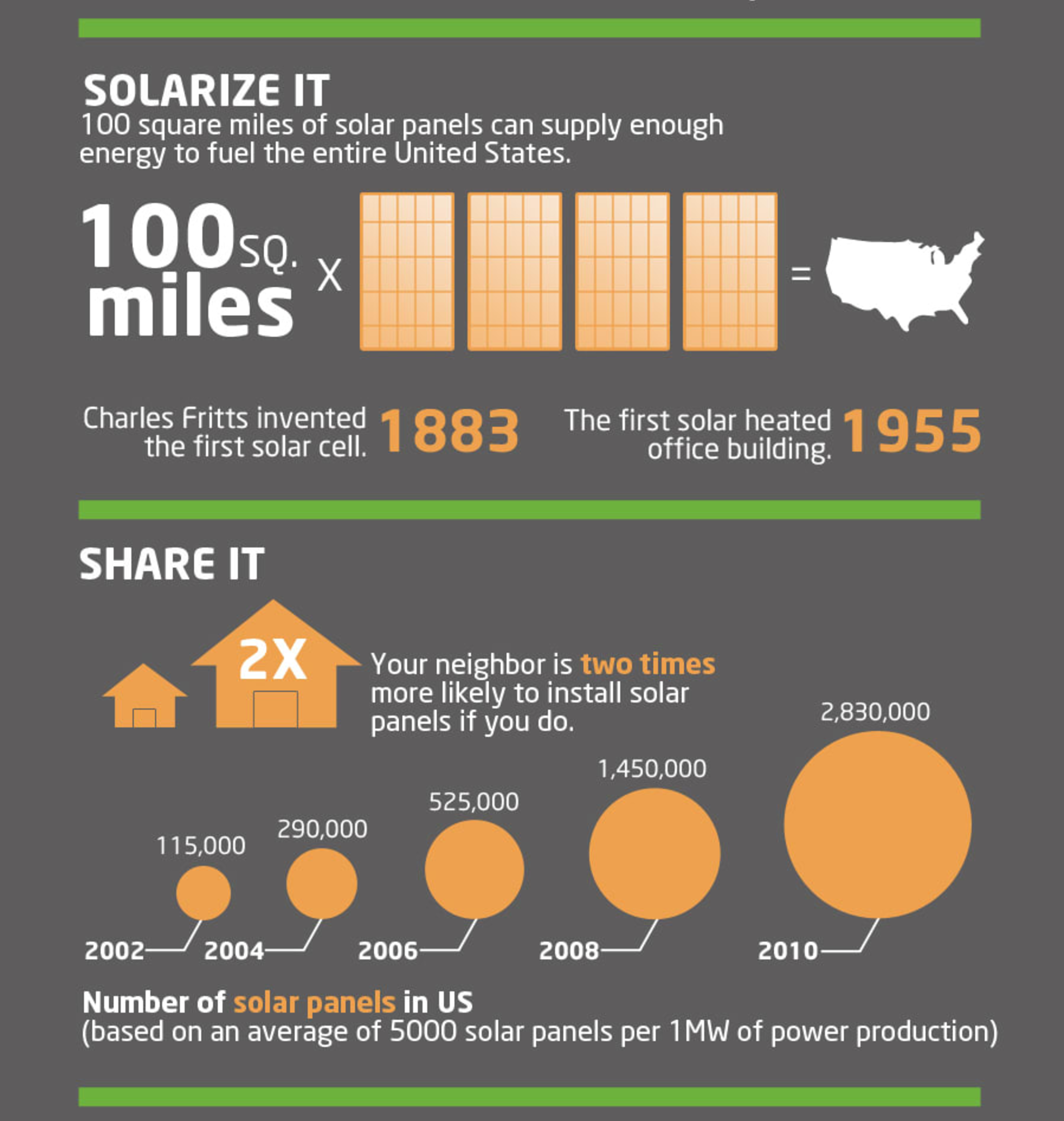

Solar energy has hit the mainstream. Once limited to consumers with deep pockets and strong environmentalist values, solar panels are less expensive than ever and are saving customers huge amounts of money per year.1 As a result, solar has a fast-growing appeal among middle-class Americans.

But if you're considering making the solar switch, how will you pay for the equipment? Who installs the panels, and under what terms?

There are two ways to switch to solar panels for your home– leasing or buying. Each option has unique advantages and disadvantages, not to mention short and long-term financial implications. We’ll examine the options, and help you understand what’s best for your budget and electricity needs.

Home Renovation Services Near Me.

Leasing Solar Panels

According to the Solar Energy Industries Association (SEIA), solar energy now powers more than 600,000 US homes.2 Every three minutes, another home makes the switch to solar. That kind of growth is substantial, but many solar enthusiasts don’t own the panels on their rooftops. They lease them.

Pros of Leasing

Leases allow to you go solar even if you don’t have thousands of dollars for a down payment. While leasing won’t allow you to maximize energy savings when you switch to solar (for that, you’ll have to buy your panels), it can still significantly lower your monthly energy costs. The advantages of leasing include:

Low-cost financing: Leasing lets you put solar panels on your home and start saving right away, usually for $0 down. Instead of paying your local utility company for power, you’ll just pay the solar panel leasing company to use the system.

Multiple financing options: Depending on your circumstances, you can usually choose a solar lease or a power purchase agreement (PPA).3 With a solar lease, you only pay the leasing company for the solar equipment; you can use as much energy as you please. On the other hand, a PPA lets you pay for the power you consume at a set price per kilowatt hour. With a PPA, monthly fees account for the power itself, not the equipment.

Maintenance and repairs: Since you don’t own the panels, you don’t have to fix them when they break! The leasing company will handle all solar panel maintenance and repairs.

Option to purchase: At the end of your lease, you can purchase the solar energy system at a depreciated market value or, sometimes at a discounted price,4 depending on the terms of your lease.

Lower energy costs: Leasing home solar panels is not like leasing a car, which usually results in overpaying for use of the vehicle. If you live in a state where solar energy is at least as cheap as the grid,5 you’re likely to enjoy equal or lower monthly energy costs even though you’re leasing a system from someone else. You can use the solar energy cost calculator from the Institute for Local Self-Reliance to estimate your saving.

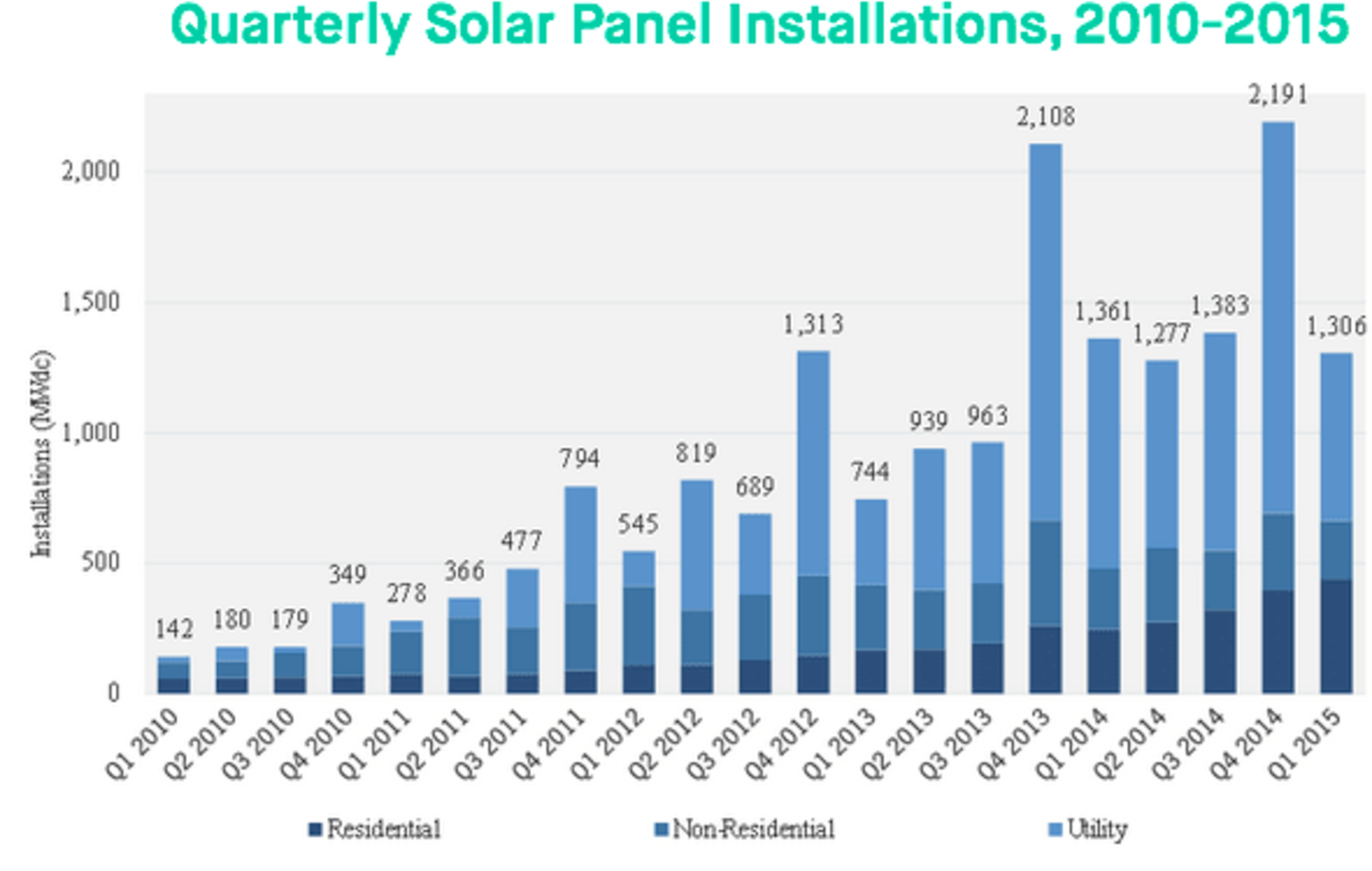

Source: Green Tech Media Research and Solar Energy Industries Association

All in all, there’s a lot to like about leasing rooftop solar panels! When you combine low to nonexistent startup costs with instant energy savings, and it’s easy to see why so many people are going solar.

Cons of Leasing

While leasing might be ideal for some buyers, it isn’t right for everyone. As a lessee, you will have to reconcile the benefits of leasing with:

Contractual terms: Solar leases or PPAs typically last 20 years – sometimes longer.6 On one hand, two decades is a long time. On the other hand, many utility companies already enjoy a local monopoly, which is tantamount to a lifetime “contract.”

No tax benefits: Owning your own solar panels usually qualifies you for various tax credits and rebates (more on those in a bit). If you lease your system, the leasing company gets to enjoy those benefits – not you.

Lack of ownership: Those solar panels aren’t yours, they belong to somebody else. To many homeowners, not having control over equipment that lives on top of their homes simply isn’t appealing.

In most cases, these disadvantages shouldn’t discourage you from switching to solar. You’ll likely save on current monthly electric bill, and can always purchase the panels later if you want.

Hidden Costs of Leasing

As with most home improvement efforts, leasing solar panels isn’t free from obscure or unexpected costs. Even if things appear straightforward and you like what you’re hearing from the leasing company, keep the following possibilities in mind and mitigate them by performing due diligence.

Source: etoncorp.com

Insurance premiums: Depending on your homeowners insurance policy, installing solar panels on your roof could leave you with a higher premium. By the same token, solar panels could lower your premium, but you should talk with your insurance provider before committing to a lease.

Roof damage and rebuilding: Solar panels are mounted to your roof, and there’s a chance they will damage it. Be sure your lease specifies who is responsible for damage to the roof and who will cover any necessary rebuilding or restoration.7 If you’re responsible for those costs, you need to know about it.

Remember, you’re about to make a serious modification to your home. Checking with your insurance company and understanding your lease are part of your homework. “Hidden” costs won’t be hidden if you’re aware of them!

Buying Solar Panels

In a sense, solar panels are the same thing today that they were ten years ago: an investment. The difference is thanks to lower costs, they now can quickly deliver a positive return.

Unfortunately, solar panels have five figure price tags before rebates or tax incentives. Though much more affordable than a few years ago, the price of solar panels still puts them out of reach for many would-be cash buyers, hence the popularity of leasing.

Pros of Buying

Why purchase your own solar panels? The answer is simple: more money in your pocket. Invest in solar panels today, and you will reap financial rewards in the future:

Source: etoncorp.com

Tax credits and rebates: The federal government and most states will help you pay for green energy! In addition to the Residential Renewable Energy Tax Credit,8 which covers up to 30% of costs, all 50 states offer incentives to leave the grid. To see how your state helps cover solar panel costs, refer to the North Carolina Clean Energy Technology Center’s database of state incentives for solar and other renewable energies.

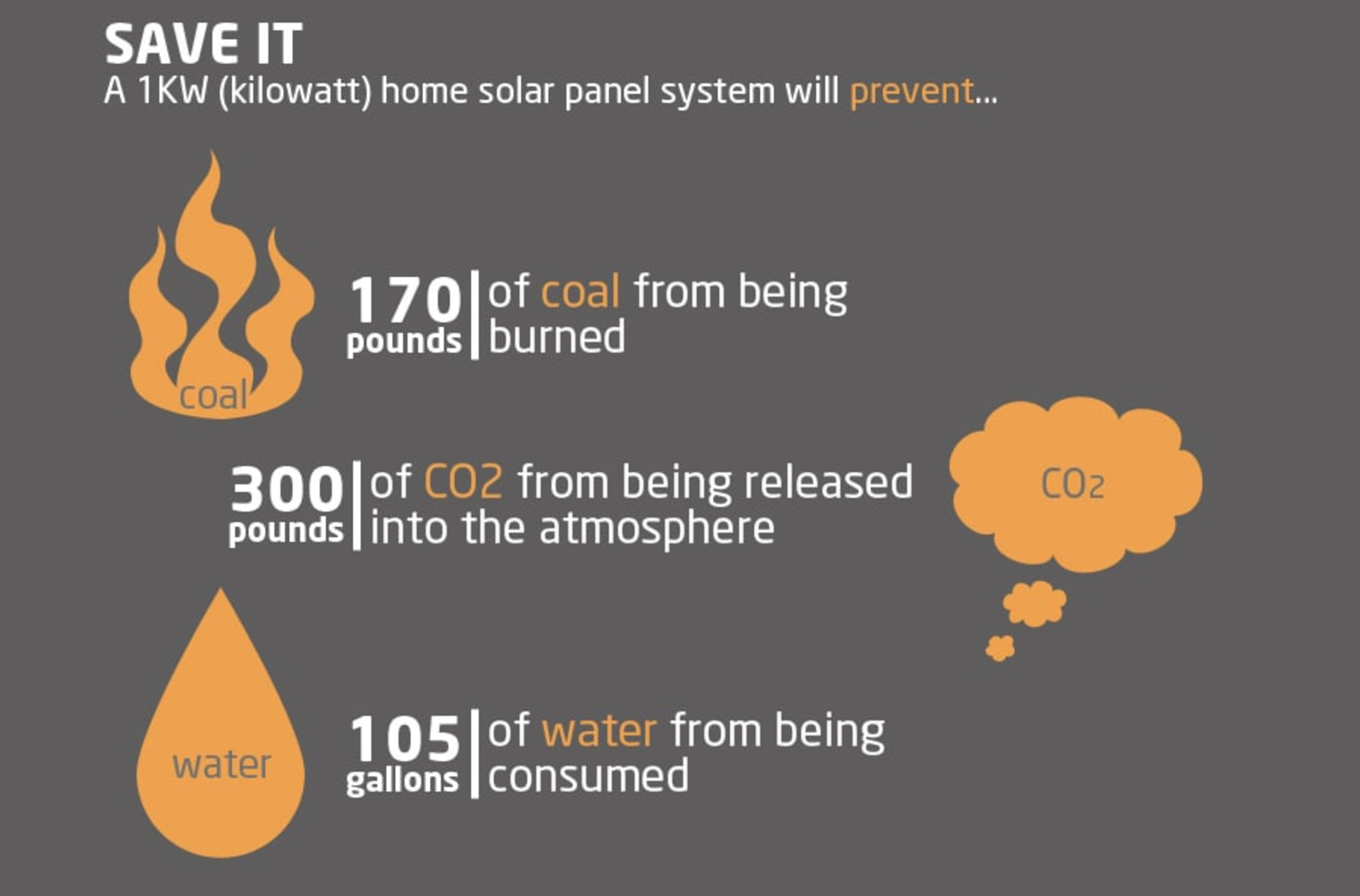

Free energy… eventually: To oversimplify a complex process, solar panels can pay for themselves.9 The length of time it takes for that to happen depends on your energy use and how much you pay for your solar energy system, but the fact remains that you will recoup your investment – and probably much more! Excess electricity is sold back to utility companies by what is known as net metering where the utility installs a bi-directional meter that records power bought by a customer and then subtracts the excess power generated and pushed back into the grid by the customer.

Solar Renewable Energy Credits (SRECs): some states,10 you can sell unused energy generated by your solar panels back to the utility companies in the form of SRECs. Instead of paying your local utility for power, they’ll be sending you checks!

Resale value: Buyers tend to pay more for houses fitted with solar panels.11 Go solar, and you may increase your home’s value.

By now may be thinking, “Leasing sounds good, but buying seems even better.” With so many reasons to buy solar panels, why would anybody lease? Unfortunately, there are some risks to purchasing your own system.

Cons of Buying

Buying solar panels has never been more affordable, but that doesn’t make it affordable for everyone. Consider these risk to buying your own system:

Time: Those positive returns on your solar investment don’t arrive overnight. For some buyers, it takes around 10 years.4 If your state doesn’t provide many incentives, or you’re unable to sell SRECs, it may take even longer.

Maintenance and replacement: Solar panels won’t last forever, and they could need maintenance between now and when they fail. If you own solar panels, you’ll be on the hook for all those repairs. How long will your system last? Most manufacturers offer warranties of 20 to 25 years for solar panels and 10 years for solar inverters.12

Ultimately, the disadvantages of buying solar panels are similar to the disadvantages of other investments with high up-front costs. To get in the game, you have to part with a lot of cash and wait several years for the return.

Hidden Costs of Buying

Wondering what else you’ll have to pay for when you purchase solar panels? Here are some potential hidden costs:

Expiring tax incentives: Solar tax credits may not last forever.13 As residential solar becomes cheaper and more popular, it’s probable many states – and possibly the federal government – will reduce or eliminate incentives for going solar.

Installation: Don’t forget to calculate installation charges into your up-front solar energy system costs. Grid-tie and off-grid systems have different installation costs,14 so you need to understand what you’re buying and how much you can expect to pay.

As with leased systems, additional hidden costs include the potential for roof damage and higher insurance premiums.

Conclusion

Rooftop solar panels have a bright future. Fossil fuel prices tend to increase over time, but the price of solar energy is rapidly falling. That’s because solar energy isn’t a fuel – it’s a technology that’s becoming ever more efficient.15

Whether you buy or lease home solar panels, you’ll be taking advantage of that efficiency. Just be sure you understand the advantages and disadvantages of each choice so you can make the most financially responsible decision.

When you’ve decided to lease or buy, contact a professional who can explain the next steps. You’ll need to determine whether your roof can accommodate the panels and compare bids from different installers or leasing companies.

Graham ShorrAuthor

Graham has worked in content marketing and strategy for Fortune 500 companies and niche brands in the Energy and Software industries. He graduated from Carnegie Mellon University with a degree in Professional Writing.

Sources

1. http://www.npr.org/2015/04/10/398704224/how-solar-power-has-gotten-so-cheap-so-fast/

2. http://www.seia.org/news/united-states-installs-1354-mw-solar-q3-2014

4. http://www.npr.org/2015/02/10/384958332/the-great-solar-panel-debate-to-lease-or-to-buy

6. https://www.energysage.com/solar/financing/should-you-buy-or-lease-your-solar-panel-system

8. http://energy.gov/savings/residential-renewable-energy-tax-credit

9. . http://www.bloomberg.com/news/articles/2014-10-29/while-you-were-getting-worked-up-over-oil-prices-this-just-happened-to-solar

10. http://www.greentechmedia.com/research/srec-market-monitor

11. http://www.nytimes.com/2015/02/22/realestate/solar-panels-and-home-values.html?_r=0

12. http://solarenergy.net/solar-power-resources/10-things-to-know-before-going-solar/

13. http://www.nytimes.com/2015/01/26/business/worry-for-solar-projects-after-end-of-tax-credits.html